L'un des moyens les plus sûrs d'obtenir le Viagra original est de l'acheter surPharmacie Francieen ligne.

Oh Canada!

Oh Canada! What do Canadian pensioners have to do with Front Range fracking? Find out in our Boulder Weekly cover story.

It’s a familiar story: a rich country develops oil fields in a heavily indebted nation with lax environmental regulations. Local residents object, claiming that oil and gas extraction degrades their air, water and quality of life. Protests mount as the foreign energy company steamrolls the permitting process. Locals appeal to elected officials, who are powerless to intervene. The rich country tries to influence local elections in the foreign country. Complaints about spills and leaks pour in. Lawsuits fly. There are rumblings that civil disobedience may erupt if the foreign developers continue marching through the countryside.

This scene has been repeated around the world; in Nigeria, Ecuador, Indonesia and elsewhere. In what economists call the “resource curse,” countries with minerals or oil are exploited by foreign powers and end up with damaged land, poisoned waters and sullied air.

In a new twist to an old tale, however, the “foreign developer” in this case is Canada, and the “neighbor” is the United States. Specifically, Boulder County, Colorado.

In October 2015, the Canada Pension Plan Investment Board (CPPIB) announced a $900 million deal to purchase all of the oil and gas assets in the Denver-Julesburg (D-J) Basin owned by Encana, at that point one of the largest producers in Colorado. Many of Encana’s holdings along the Front Range were located in rapidly growing metropolitan areas north of Denver and astride the Interstate 25 corridor between Colorado’s capital and its fourth-largest city, Fort Collins. On Nov. 16, 2015, the CPPIB registered Crestone Peak Resources LLP with the State of Colorado as a “foreign limited liability company” in Delaware and listed its principal address as One Queen Street East in Toronto.

The purchase deal stalled as financial and social pressures bore down on the oil and gas industry. Some Encana holdings were in places, such as Broomfield and Boulder counties, that had banned hydraulic fracturing, or fracking, in 2012 and 2013. The oil and gas industry challenged those bans, and the legal fight reached the Colorado Supreme Court as the Encana deal was being negotiated. In early 2016, the fracking bans were still in place, oil bottomed out at $34 a barrel in February, Encana’s stock had dropped to below $5 (from its five-year high of more than $24 in the summer of 2014), and many companies in the oil and gas patch were stressed. Front Range citizens’ groups were organizing ballot measures to force new oil and gas development farther away from where people lived, and suburban parents who had never done anything more political than attend PTA meetings became “fracktivists” and planned civil disobedience actions in local libraries.

Then came the Colorado Supreme Court’s landmark May 2016 decision. That ruling invalidated all “local control” bans in favor of statewide authority to foster oil and gas development. That has historically meant that the state has approved every completed drilling permit application. Citizens across the Front Range were outraged after working to get local fracking bans approved by voters.

WHY WOULD WIDOWS IN WINNEPEG, RETIREES IN RICHIBUCPO AND TEACHERS IN TORONTO CHOOSE TO INVEST IN COLORADO’S ESCALATING FRACKING WARS?

The Supreme Court ruling, however, was good news for the Canadians.

Soon after, on Aug. 11, 2016, the CPPIB announced the purchase from Encana, a Canadian company with a U.S. subsidiary, and created a new company, Crestone Peak Resources. When the negotiating dust settled, the CPPIB had picked up a chunk of sub-surface Colorado real estate and wells producing on it for approximately 30 percent less than had been announced just months earlier. According to documents filed with the Colorado Oil and Gas Conservation Commission (COGCC), Crestone became one of the largest companies in Colorado focusing on drilling in residential areas of the state’s most populous region, including more than 100 operating “legacy” wells in Boulder County that pre-dated larger-scale fracking and horizontal drilling facilities in wide use today. The CPPIB reported paying just $609 million for the Encana deal. An affiliate of the Broe Group, a Denver-based company, acquired 3 percent of Crestone.

The Canada Pension Plan was moving full-steam ahead into a Colorado firestorm.

The CPPIB is a quasi-governmental, $368 billion behemoth that invests payroll withholding taxes from Canada’s workers on behalf of 20 million contributors and beneficiaries, and pays benefits much like the U.S. Social Security system does. Its portfolio is vast, and includes renewable energy projects, real estate, business ventures around the world, as well as fossil fuel production and pipelines.

Today, however, institutional investors like the CPPIB are becoming increasingly aware that new oil and gas development is burdened with with moral, legal, financial and ecological problems. CPPIB’s Colorado investment raises a pressing question for people living near Crestone’s operations as well as for Canadian beneficiaries across the country: With all the investments in the world available to them, why would widows in Winnepeg, retirees in Richibucpo and teachers in Toronto choose to invest in Colorado’s escalating fracking wars?

Toxic assets

It may simply be that the CPPIB was willing to go where other companies wouldn’t because the pension board thought it scored a deal from a distressed seller that would yield strong long-term results for its beneficiaries.

The CPPIB did not respond to multiple phone messages, email requests for an interview or a list of emailed questions sent over the course of more than a month, despite having an elaborate public relations department. Just before deadline, Darryl Konynenbelt, CPPIB’s director of global media relations wrote in an email: “CPPIB declines to comment. We refer all questions to Crestone.” (See questions sent to CPPIB at end of article.)

One question was whether the CPPIB knew it was purchasing what one oil and gas engineer (who wishes to remain anonymous for fear his business would be affected by criticizing the industry) told me were known as “toxic assets” by industry insiders: oil and gas leases located in controversial territory scattered among housing developments sprouting at nail-gun speed in the rapidly growing state.

In an interview, Encana spokesman Doug Hock said the fact that many of the company’s Colorado assets were located in areas where there was growing resistance to oil and gas development “was a factor” in the decision to sell to the CPPIB. He emphasized, however, that it wasn’t the main one. “Our D-J Basin assets certainly had challenges compared to our other assets,” Hock said. “They were good wells, but they didn’t fit into our growth strategy.” Pressed on the question about the timing of the sale and the last-minute price drop, Hock wrote in an email: “I’ve been told that there are non-disclosure agreements that preclude the parties from discussing those details.”

Crestone Peak, in an email from its public relations department responding, said there was nothing unusual about the price dropping from $900 million to $609 million. “It’s very common in acquisitions for the valuation of a company to change from once the acquisition is announced to final closing,” it stated. The company declined to discuss specifics of the sale or current valuation because it is a private company.

Whatever the reasons for the reduced price and Encana’s motivation to sell, the CPPIB must have known there would be substantial pushback in Colorado — and in Canada. Several of the CPPIB’s directors as well as several of Crestone’s board members and executives had worked for Encana. This includes Avik Dey, a CPPIB managing director and head of energy and resources, who has worked for all three and is currently Chairman of the Board at Crestone Peak Resources. In a CPPIB press release on Oct. 8, 2015 announcing the deal, Dey said, “This investment offers attractive economics and aligns well with our strategy for the energy sector.”

Even in Canada, however, fracking is highly controversial. The fact that the CPPIB created a new oil and gas company in Colorado rather than simply investing in an existing one added another quizzical twist to the deal. “I don’t think they would ever have invested in a fracking company in Canada,” said John Bennett, a senior policy advisor to the environmental group Friends of the Earth Canada, where three of the country’s 10 provinces have banned the practice. Bennett says that Canada’s commitment to meeting the Paris climate goals is politically popular, which requires a concerted global flight from fossil fuels. “It’s a very odd thing for this pension fund to be doing,” he said. “Most Canadians would be surprised to know they own a fracking oil company in Colorado.”

Denise Melanson, 70, is one such Canadian. A retired medical social worker who lives in Richibucpo, New Brunswick, Melanson receives two pensions from the CPP: one that she paid into during her years of employment, and the other what she calls an “old-age” benefit that she started receiving when she was 65. When she learned that some of her benefits might be coming from fracking operations in Colorado, she said in a phone interview, “I was horrified.” Melanson had been involved in educating her community about the health and environmental impacts from fracking and in passing the moratorium in New Brunswick. “It appalls me that we are doing that to other people instead,” she said. “I’d much rather not be receiving money that was earned by making other people miserable.”

Most Coloradans, on the other hand, would probably be surprised to know that Canadian pensioners like Melanson are invested in drilling operations in the Centennial State’s suburban backyards.

Coloradans that do know about the Canadian connection are baffled. “I have to wonder if the beneficiaries of the pension fund’s investments understand what they’re investing in,” said Boulder County Commissioner Elise Jones. She said that as far as she knew, virtually every elected official in the county, including those from the county’s municipalities, as well as the overwhelming majority of people who live here, oppose the kind of residential drilling plans that Crestone has proposed — and wish they could halt it. Concerns range from the planned drilling locations in and around homes, schools and Boulder County Open Space holdings, to negative health effects from the industrial facilities’ emissions, to the oil and gas industry’s impact on the Denver metropolitan area’s persistently poor air quality, to climate change impacts from fossil fuel developments. “Do these pensioners know how much opposition there is to their investment?” Jones wonders. “If they did, they’d realize this is not wise or ethical. It boggles the mind.”

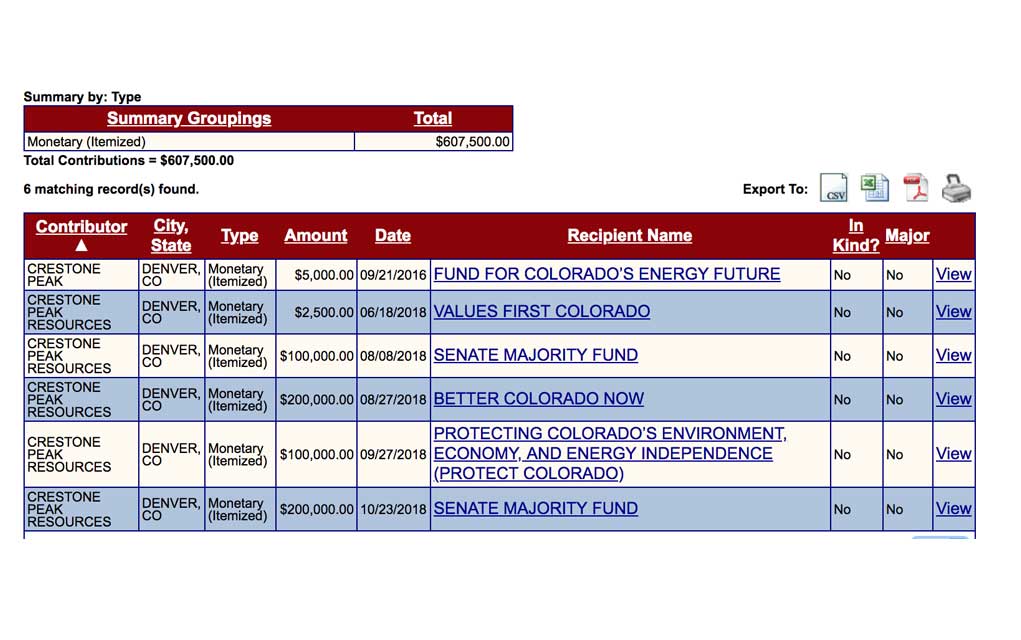

Along with its purchase of these controversial assets, Crestone also invested in Colorado’s 2018 election. Oil and gas issues figured prominently up and down the ballot, from the governor’s race to several ballot initiatives. Crestone Peak contributed $607,500 toward the tens of millions of dollars the industry contributed during Colorado’s last election cycle to support groups that directly or indirectly opposed Proposition 112, the failed setback initiative that would have required new oil and gas development to be placed at least 2,500 feet from homes and schools. Crestone donated to the pro-industry group Protect Colorado, which campaigned to defeat Proposition 112, and other political groups supporting Republican state legislature candidates that unswervingly support the oil and gas industry. $300,000 of those contributions went to a group that supported Republican candidates for the state senate, which remained in Republican control until the last election and had reliably killed any legislation opposed by the energy industry.

Austin Graham, legal counsel for the non-partisan Campaign Legal Center in Washington, D.C., reviewed Crestone’s contributions for their legality with regard to both federal and Colorado campaign laws, at my request. Federal law requires that foreign-owned companies’ contributions to state campaigns meet a two-part test: the contributions must be drawn from money made from U.S. operations; and that the person making the decision to donate is a U.S. citizen. Since Crestone is a privately held, Canadian-owned company whose only public financial disclosure indicated the company’s value has declined since being formed, it is not obvious where the money came from or who made the decision to contribute to the election. “How would you know?” Graham asked.

Crestone stated in an email that it follows all state and federal laws, and as a company operating in Colorado, “Crestone allocates a certain amount of funds each year to dedicate to organizations and initiatives that are important to our team. Crestone leadership ultimately makes the decision on which organizations these funds are donated to.”

As far as Colorado law is concerned, the Senate Majority Fund is known as a 527 political organization, which can receive unlimited contributions from anybody, including foreign entities, said Steve Bouey, the campaign finance program manager for the Colorado Secretary of State’s office. The other organizations that Crestone contributed to include “independent expenditure committees,” which are also allowed to legally receive contributions from foreign-owned corporations.

“Regardless of whether any laws were broken,” said Graham from the Campaign Legal Center, the CPPIB “spent a substantial amount of money trying to influence Colorado voters. I think it’s worth bringing to the public’s attention.”

CRESTONE PEAK CONTRIBUTED $607,500 TOWARD THE TENS OF MILLIONS OF DOLLARS THE INDUSTRY CONTRIBUTED DURING COLORADO’S LAST ELECTION CYCLE TO SUPPORT GROUPS THAT DIRECTLY OR INDIRECTLY OPPOSED PROPOSITION 112.

Crestone has applied for a Comprehensive Drilling Plan (CDP) to move into Boulder County, but the applications for drilling permits are still awaiting approval from the COGCC, which is slated to meet about Crestone’s CDP in late April in Boulder. If approved, the plans will have to survive an ongoing lawsuit filed by Boulder County that a judge recently ruled must wait for the COGCC’s final determination to move forward. If Crestone prevails in court, the company will be subject to Boulder County’s new oil and gas regulations that went into place in March 2017. Those regulations, in turn, are likely to be challenged in more lawsuits. The bill that is being considered at the state legislature (Senate Bill 181) may give more weight to Boulder County’s concerns for more “local control.” However, industry representatives have vowed to develop their mineral rights in accordance with whatever Colorado law permits, and the new law is not likely to permit blanket bans on new oil and gas development.

Although Boulder County still has not seen any new drilling since its ban was lifted, the impacts of residential oil and gas development are plain to see across the county line to the east. In Weld County, there are 21,694 active wells, according to the COGCC website. There, residents have been powerless to stop multi-well pads and mini-industrial complexes from being located near homes and school playgrounds. At the same time, new tract homes have been built within 120 feet of existing oil and gas facilities, since state regulations allow local land-use decisions when they involve approving subdivisions next to oil and gas infrastructure.

Pressure has been mounting around the state to put some brakes on the rapidly expanding oil and gas industry in Colorado over the past decade. Repeated fires at oil and gas sites and a deadly explosion in Weld County in 2017 from an abandoned pipeline located less than 200 feet from a home in Firestone that killed two people only added to the tensions. So have recent scientific reports that Weld County’s hydrocarbon production was sullying Boulder County’s air and contributing significantly to increasing air pollution in the Denver metro region that has placed Colorado in the crosshairs of the Environmental Protection Agency for its worsening “non-attainment” of federal clean air standards.

Eerie, Colorado

Perhaps no place illuminates these conflicts better than Erie, which straddles both Boulder and Weld counties. Erie, a sleepy farming community with a population of about 2,000 people in 1990, has grown to a bedroom community of about 25,000 residents today.

The first citizen complaint against Crestone’s operations with the COGCC was filed on Nov. 16, 2016, just three months after the CPPIB/Encana deal was finalized. Noise from a drilling operation smack in the middle of Erie was so loud it was “like a huge semi truck parked in our driveway,” according to the anonymous complaint. Other complaints poured in, reporting rumbling and shaking of Erie homes, pictures falling off of walls, and disturbing vibrations night and day for weeks on end. Dank smells emanated from the drilling sites, which were just a few hundred feet away from rows of large tract homes, parks, schools, a skate park and even the city offices. Citizens started a black humor joke that their town should be renamed “Eerie.”

Monica Korber, 58, who works from her Erie home as an efficiency consultant to businesses, recalls trying to sleep with her bed shaking through the night. Fearful and concerned, she asked other neighbors if they had experienced the same thing, and soon dozens of people were sharing stories on social media and asking what this new company Crestone was doing to rattle their lives so viscerally. “We never got a straight answer,” Korber said.Video Player00:0000:38

(This video was taken by a COGCC inspector and is available on its website. Ted Wood added the text.)

After the rumblings stopped with that phase of the project, Crestone pressed on. Soon, Erie residents were complaining at COGCC meetings and on the agency’s website about noxious smells, leaks, nosebleeds, headaches, industrial noises and lights burning all night outside their bedroom windows. Korber learned that Crestone was applying for even more permits to drill, and drove to Denver last October to speak at a COGCC meeting. She told the commissioners, with her best grandmother-of-five scolding voice: “I bet that not one of you lives in Erie.”

Not one of the nine commissioners do.

Erie’s experience with Crestone isn’t isolated. The number of complaints filed against Crestone is almost twice as many as the next five oil and gas companies conducting business in Colorado combined. More than 1,000 complaints against Crestone’s operations were filed with the COGCC between November 2016 and February 2019. The only other company that comes anywhere close to that number is Extraction Oil and Gas, another relatively new company with holdings in many residential areas on the Front Range (with 245 complaints over the same time period). The other major operators in the D-J Basin, including Noble, Anadarko/Kerr McGee, PDC and SRC collectively only had 350 complaints over the same time period. One likely reason: most of the other top producers are operating on agricultural lands or in much less populated areas.

Jason Oates, Crestone’s spokesperson, has repeatedly stated that citizens have abused the complaint process in Erie by organizing complaining campaigns. In their email response to questions, Crestone’s public relations department said that, “while none of the complaints resulted in a violation of state standards by the COGCC or the CDPHE [Colorado Department of Public Health and Environment], we knew we needed to make some changes in our operations. We took an above-and-beyond approach to further lessen the temporary impacts that we may have on neighboring communities.”

One such flurry of impacts and complaints came after Crestone’s operations caused a release of toxic gases at a site in Erie that occurred just 25 yards from the Aspen Ridge Preparatory School playground in September 2017. Crestone was plugging and abandoning a set of wells, and had been venting large quantities of volatile organic compounds (VOCs) for an indeterminate amount of time before a resident smelled noxious fumes and complained to the COGCC. The agency documented a large release of VOCs related to oil and gas emissions that have been linked to a number of health problems in Colorado and around the world, including increased rates of asthma, childhood leukemia and low-birth weight babies. Those toxic emissions wafted directly onto the school playground of the Kiddie Academy Childcare Center and Aspen Ridge, according to the COGCC’s report on the incident.

MORE THAN 1,000 COMPLAINTS AGAINST CRESTONE’S OPERATIONS WERE FILED WITH THE COGCC BETWEEN NOVEMBER 2016 AND FEBRUARY 2019.

The COGCC ordered Crestone to cease operations until the problem was fixed, but parents say they didn’t hear about the leak for months. Mark Kadlecek, who has three children who attended Aspen Ridge, found the “Notice of Alleged Violation” posted on the COGCC website on Oct. 25, more than six weeks after the violation.

Kadlecek wrote to the COGCC and local elected officials, sputtering outrage. “All three of my young children between the ages of 6 and 8 years old attend Aspen Ridge,” he wrote. “This is a place that I thought they would be safe.” Kadlecek tried to make the point that so many in Colorado communities have reiterated: what is legal in Colorado is simply not right. “Common sense mandates that oil and gas operations do not belong in close proximity to homes and schools,” he wrote.

After the public outcry, Crestone issued a statement that was so bland it further inflamed residents: “We sincerely apologize for this oversight.” In its emailed statement, Crestone added, “Activity at the location wrapped up with no further incidents.”

The COGCC fined Crestone $10,000, according to Mike Leonard, the agency’s community relations manager.

Christiaan Van Woudenberg, one of Erie’s newly elected Trustees, says that the Aspen Ridge incident and Crestone’s other operations have led to one frustration after another. Different complaints — about noise or traffic or vibrations or smells or lights or emissions — need to be reported to different agencies, which frequently don’t report to each other.

The bigger picture, he says, is that when companies like Crestone come into a small community such as Erie, dangling potential tax revenue and claiming (as Crestone spokesman Oates told a community meeting) that there are “no health impacts” from fracking, it is almost impossible not to be steamrolled. Local elected officials in places such as Erie, Broomfield and Boulder say they are hamstrung by state laws that limit their ability to say no to new oil and gas development. “Erie is fracked,” Van Woudenberg said in an interview. “We lost. We’re the cautionary tale.”

A fraught investment?

Besides the fact that Crestone is seeking to operate in communities that oppose it, there’s a larger question for the CPPIB: Is residential drilling in Colorado a smart investment?

Crestone continues to face legal challenges that are increasing the cost of doing business in Colorado. The company has been involved in lawsuits, protests, leaks and alleged violations of state regulations in multiple communities, including in Weld County and Broomfield, a fast-growing city and county halfway between Boulder and Denver. Crestone, in turn, has sued the state and at least one other oil and gas company, alleging interference in its operations.

From what is known about Crestone’s financial picture, it hasn’t performed well to date. While Crestone is private, there are several clues that the CPPIB’s Colorado investment may be problematic. As of Feb. 15, 2019, the CPPIB’s website stated that the value of the investment had dropped to $543 million from the purchase price of $609 million, more than a 10 percent decline.

Another possible clue about Crestone’s financial situation comes from Extraction Oil and Gas, which went public in October 2016 at almost the same time the Encana/CPPIB/Crestone deal was finalized. It’s not possible to make a “well-pad-to-well-pad” comparison between the two companies, since one is publicly traded and one is private, with substantially different corporate structures and reporting requirements. Still, many characteristics are similar, including the fact that both companies started by purchasing larger companies’ “toxic assets” in populated communities along the Front Range. Both are buffeted by the oil price roller coaster, from highs above $100 a barrel in late 2014 to a low of below $40 in early 2016, only rebounding to the high $50 range today. Crestone and Extraction are also number one and number two in citizen complaints filed against them with the COGCC among the top six producers in the state.

Another fiduciary clue: Extraction was trading for $23 a share around the time of its October 2016 IPO. Its stock tumbled to below $4/share — more than an 80 percent drop — before rebounding to $4.54 after its recent earnings report in late February 2019. It then promptly dropped to $3.60 a share in early March.

Analysts are mixed about the future of shale development, with some predicting slow growth in 2019 and others convinced that many parts of the industry are burdened with debt and uncertainty about future regulatory regimes, international price fluctuations and the increasingly competitive cost of renewable energy technology. Other investors remain bullish on oil stocks but are moving away from riskier investments in politically volatile countries such as Venezuela, Russia and Saudi Arabia — and are looking to U.S. fracking operations as a safer alternative. Both Noble Energy and Anadarko reported record Colorado oil production in 2018.

From a longer-term perspective, a growing number of analysts say that investments in fossil fuel companies don’t make sense at a time when many fracking operations are losing money, evidence mounts that oil and gas operations have significant and growing environmental and health impacts, liability from abandoned wells is getting more attention, and places like Boulder County and California are aggressively moving towards decarbonizing their energy supply.

Then, there’s climate change, looming like a drilling rig’s late afternoon shadow over the fossil fuel investment debate. Canada, a signatory to the Paris climate agreement, faces some cognitive dissonance with the CPPIB’s fossil fuel portfolio. Financial and legal analysts as well as climate activists point out that Canada cannot export its fossil fuel investments and still claim it is moving to reduce its carbon footprint. In a report released in January entitled “It is Time,” two Canadian law professors, Janis Sarra of the University of British Columbia and Cynthia Williams of the Osgoode Hall Law School at York University, conclude that, “The CPPIB has enormous potential to help shift governance practice to meet the issues discussed in this report.”

That potential has yet to be unleashed, said Williams in an interview. Canada is already heavily invested in the oil and gas sector, and all recent indicators are that those investments “already have a lot of risk,” she said, partly exemplified by the drop in value of the Canadian dollar and declining returns from oil and gas investments in comparison to other sectors. “Why would the CPP be doubling down on oil and gas developments?” she asked.

Various organizations in Canada have tried to push the CPPIB toward a more sustainable, lower-carbon portfolio, without much success, said Bennet of Friends of the Earth Canada. The CPPIB has expressly avoided committing itself to “Environmental, Social, and Governance” (ESG) investments, stating that, “Consistent with the CPP Investment Board’s belief that constraints decrease returns and/or increase risk over time, we do not screen stocks or eliminate investments based on ESG factors. The CPP Investment Board considers the securities of any issuer all of whose businesses are lawful, and would be lawful if carried on in Canada, as eligible for investment.”

As many affected residents have noted, what is lawful in Colorado isn’t necessarily admirable. Many state laws were written in an earlier era of oil and gas exploration. They never anticipated new horizontal drilling and fracking techniques that allow companies like Crestone to build pads of 10, 20 and 30 wells and drill underneath hundreds of people’s homes for miles in every direction. These well pads are accompanied by rows of storage tanks, condensers, combustors, separators and thousands of truck trips a day, in and out of these mini-industrial complexes located in close proximity to housing developments, schools, playgrounds, watercourses and otherwise baby stroller-packed suburban neighborhoods.

Divest/invest

Groups looking to aggressively address climate change are targeting pension funds around the world. As concerns about climate change resonate across the globe, investments in fossil fuel companies are increasingly seen as bad bets. Viable alternatives are emerging — with better financial rewards.

In the U.S., the burgeoning divestment movement has made great strides in the past few years, ever since Stanford made headlines by selling off its coal stocks in 2014. Clara Vondrich, the global director of DivestInvest, a philanthropy movement that encourages large institutional investors to move away from fossil fuels in favor of more sustainable investments, said since 2014, more than 1,000 institutional investors have committed to fossil-free investments, with growth of capital investments rising from $52 billion to more than $8 trillion today.

Vondrich said that the divest/invest movement has three core pillars: moral, financial and legal. “The moral argument doesn’t sway large institutional investors,” she acknowledged. “But the financials do.”

Various backdated investment comparisons such as those done by the U.S. divestment advocacy group As You Sow confirm that portfolios without fossil fuel investments would have performed better than with them.

“You’re losing money for your beneficiaries” by investing in fossil fuels, Vondrich said. “These are underperforming assets that are also burning up the planet.”

Now, she said, the CPPIB and other large investors “increasingly have a fiduciary duty to explain why they don’t divest, rather than the other way around.”

Mark Campanele, founder of the U.K.-based Carbontracker, said that huge advances in electric vehicles are another factor likely to suppress oil demand and reduce price fluctuations that invite oil speculation. “The question for CPPIB is whether betting long-term on an old or dying technology such as the internal combustion engine is the sort of risk otherwise prudent pension funds should be taking on behalf of its members?”

One driving force behind the divestment movement is the concept of “stranded assets,” which means that the world’s oil and gas reserves cannot all be extracted and burned if Earth is to remain a livable planet for billions of humans. Since these reserves are baked into oil companies’ stock prices, they will be faced with inventory they will never be able to sell.

“Stranded assets” has moved from a fringe idea to the mainstream, in part because scientists have quantified the problem in stark terms: In a 2015 report published by Nature, the authors state that “a third of oil reserves, half of gas reserves and over 80 percent of current coal reserves should remain unused from 2010 to 2050 in order to meet the [Paris agreement’s] target of 2°C.”

Erie, calling Edmonton

Crestone is undeterred by the mounting complaints and continues to resist the community opposition. The company is moving forward with its CDP in Boulder County, which is being challenged by the County, weaving its way through the court system and COGCC approval process.

At a January 2019 conference hosted by the Rocky Mountain Mineral Law Foundation, Crestone spokesman Oates told the audience that the company had met all of the requirements laid out by the COGCC for its drilling plans, and Crestone would forge ahead into Boulder County despite citizen and local governments’ objections. “It is how, not if, we are going to drill,” Oates told the audience.

Sara Loflin, executive director of the League of Oil and Gas Impacted Coloradans (LOGIC), attended the conference and was taken aback by the “arrogance” of Oates’ remarks. In response to multiple communities’ concerns ever since Crestone started doing business in Colorado, Loflin said, Crestone has only proposed moving “closer to homes, in higher risk areas, in larger scale developments.”

In its email, Crestone disputes this and says it aims “to operate safely, responsibly, efficiently and with minimal impact on local communities, while acting as good stewards for the land, air and water. This is a priority for us because as Coloradans, we value these natural assets, and we live here, too.”

Back in Erie, grandmother of five Korber says that she and her neighbors suffer not just the proximity of the industrial operations, but also from the discord that those operations have unleashed on their community. She has joined a lawsuit against her elected officials for not doing more to protect Erie citizens.

Korber’s message to the CPPIB? “Why don’t you drill next to the homes of the people where you’re sending those retirement checks?”

New Brunswick retiree Melanson has a lot of sympathy for people like Korber, and plans to write a letter to the CPPIB. “It’s utterly indecent, what they’re doing,” she said. “I don’t want my pension coming from things like that.”

Unanswered questions for the CPPIB

1) As the Encana/CPPIB/Crestone deal was being negotiated, several communities where Encana owned Colorado assets had voted to ban new hydraulic fracturing. Those bans were overturned by the Colorado Supreme Court in May 2016, just months prior to the final purchase in August 2016. Did that Supreme Court decision factor in the deal, and how?

2) Were CPPIB executives aware of the conflicts surrounding residential drilling in Colorado? Some of Crestone’s executives are or had been involved with all three entities (Encana, CPPIB and Crestone), including Avik Dey. If the executives were aware, what was appealing about working there if the local residents had voted against it and remain opposed to this day?

3) The CPPIB states that it “integrate[s] environmental, social and governance factors into our investment analysis.” Did you do an ESG (Environmental, Social, and Governance) report on the Crestone/Encana deal, and can you share that?

4) Crestone Peak has received more than 1,000 citizen complaints on the website of the state regulatory agency, the Colorado Oil and Gas Conservation Commission, or COGCC. This number is substantially more than the five top operators in Colorado combined. Does it trouble you that the operator has upset so many people in the communities near where it operates?

5) Crestone Peak Resources reported donating $607,500 in Colorado’s last election cycle to groups that were allied with the oil and gas industry, as well as one that specifically opposed a citizen-backed ballot initiative to increase the “setbacks” from schools, watercourses and communities. Is it a normal function of the CPPIB to make contributions during foreign country’s election campaigns? Was the CPPIB aware of them? Even if it is technically legal for Crestone Peak to make these donations, does the CPPIB approve of this practice of its companies donating to influence local U.S. elections?

6) Many investment analysts around the world have made the case that backdated investment portfolios without fossil fuel investments fare as well or better, especially over the past decade. The so-called “divest/invest movement” has gained traction around the world, with many institutional investors and other pension funds choosing to divest from fossil fuel investments on financial, legal and/or moral grounds. What is the CPPIB’s current thinking about this movement, which encourages not just divestment, but also investment in companies striving to respond to what the Intergovernmental Panel on Climate Change (IPCC) recently suggested was a very short window for humanity to act dramatically and quickly before climate change becomes irreversible?

7) In the credentialed scientific community, there is virtually no disagreement that the planet is warming, human activities are largely responsible, and the burning of fossil fuels are a main cause of this warming and ancillary impacts. How do executives at CPPIB view this science, such as the recent IPCC report warning of severe climate-related threats to humanity? How do you view your continued investment in fossil fuel companies? Is there any cognitive dissonance in Canada trying to attain those goals in Canada and the CPPIB investing in more hydrocarbon exploration and production elsewhere?

This entry was posted on Wednesday, April 10th, 2019 at 1:36 pm. It is filed under All Stories, Featured Post, Oil and Gas. You can follow any responses to this entry through the RSS 2.0 feed.

Leave a Reply

All content © 2025 by The Story Group